Cannabis landlords face obstacles of finding building insurance

Table of Contents

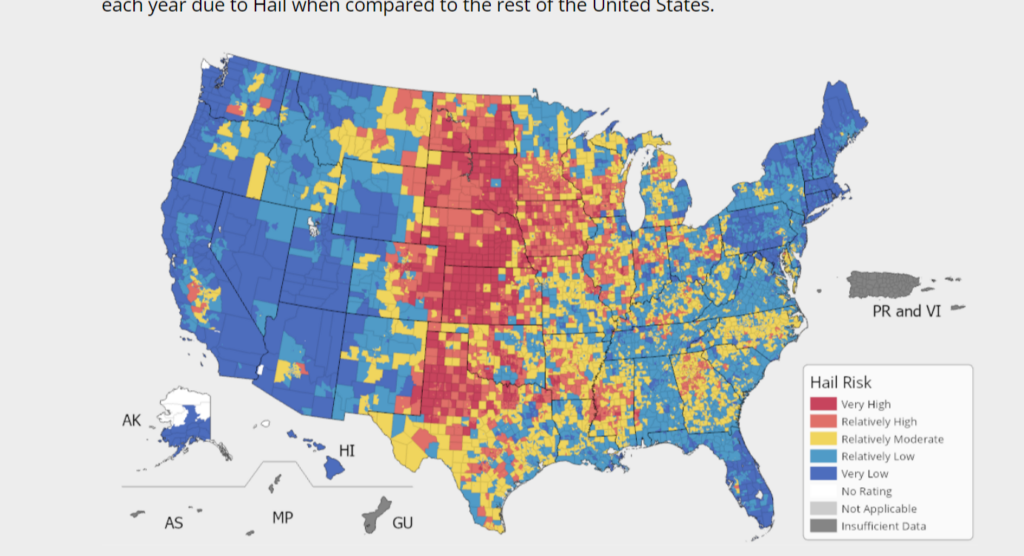

The insurance market for landlords who lease space to a cannabis tenant has continued to deteriorate in states who might experience hail, tornadoes, or high winds. States such as Colorado, Missouri, Oklahoma, and New Mexico fall into this category viewed by insurance actuaries as having a high frequency and severity of claims occurring. This means claims are happening to often and when they do, the cost to the insurance company is high in order to settle the claim.

You should know insurance companies have been trying to eliminate their risks by modifying their insurance contracts to include either higher deductibles and cosmetic damage to roof exclusions. Both of these policy changes are meant to either have the landlord pay more for the claim or eliminate the possibility from having to pay at all because the roof was cosmetically damaged versus structurally.

This has all resulted in insurance companies taking a more assertive position to 1. no longer offer coverage in any form, 2. remove wind and hail coverage, or 3. price the coverage at a high rate.

Adding wind and hail coverage is 69% higher for cannabis landlords

Landlords are now faced with having to make hard decisions on buying insurance with or without wind and hail coverage. Let’s take a look at a couple of real life scenarios with insurance carrier A offering coverage without wind and hail and insurance carrier B including wind and hail.

| General Liability: | $1,000,000/$2,000,000 |

| Building Coverage Limit: | $1,590,000 |

| Loss of Rents Limit: | $300,000 |

The annual price or insurance premium for insurance with insurance company A (No Wind and Hail) is $12,454.33. The annual price or insurance premium for insurance with Insurance company B (With Wind and Hail) is $21,064.06.

The difference between the two insurance proposals is $8,609.73 or 69% higher.

| Insurance Carrier | Annual Premium |

| Insurance Carrier A ( NO Wind and Hail) | $12,454.33 |

| Insurance Carrier B ( WITH Wind and Hail) | $21,064.06 |

Wind and hail coverage still has high deductibles and significant exclusion that may result in your claim not being covered

The landlord decides to pay for wind and hail coverage buying Insurance Company B. The decision can be further evaluated by asking the question, if I have a claim what hurdles exist before a claim will be paid and are my out of pocket costs. The offer by Insurance Company B has a 3% wind/hail deductible and Limitations on Coverage for Roof Surfacing.

This limitation is essentially a provision in the policy that basically says the roof’s integrity or ability to function must be damaged before a claim will be covered. Some policies will state if water is capable of penetrating the roof. If the damage is cosmetic as in appearance such as marred or dented, then a claim will not be covered. This means how the roof is evaluated by the claims adjuster becomes important.

Landlords could pay 33% of the cost for a new roof

Calculating the 3% wind/hail deductible is a function of taking the building limit and multiplying by the deductible. In the example above, the building limit is $1,590,000. The deductible is 3%, $1,590,000 multiplied by 3% equals $47,700.

The decision to include hail coverage includes the increased premium expense and deductible. In our example, if a hail storm resulted in a total roofing failure, then the total cost would be $56,309.73 (deductible plus increase cost of coverage). This building is 12,000 square feet. If the roof is a single ply membrane, then cost per square foot can range from 11 to 14 per square foot. Then a roof may cost as high as $168,000 to replace. This means your deductible is paying for approximately 28% of the claim. Include the additional premium expense of adding wind and hail coverage, then landlords are paying 33% of the cost for a new roof.

Final thoughts for landlords seeking coverage for their buildings

- If you have building insurance review your policy to determine if wind and hail is currently covered. Many building owners could be surprised they may not be insured for type of loss.

- If you are shopping for insurance, the quote will have a list of forms. Scan through this list to determine if wind and hail is excluded or if a separate deductible is applied to wind and hail.

- The wind and hail coverage are being offered on a combined basis. If you are more concerned about windstorms, then adding the coverage can make sense.

- The insurance carrier is charging an extra 69% of the premium to cover wind and hail. For many landlords, the peace of mind knowing you are properly covered is worth it.

- Understand how your deductible is calculated. Most carriers are offering a 2 or 3 percent deductible.