Building Owners and Landlords

Cannabis Tenants

Cannabis Building Insurance

- Retail Stores

- Dispensaries

- Cultivations/Warehouses

- Manufacturing Facililities

- Processing Centers

- Greenhouses

- Laboratories

Take the First Step: Obtain building insurance from approved cannabis insurance companies

If you own a building with a cannabis tenant operating either a dispensary, cultivation, or manufacturing facility you need insurance approved by the carrier for this type of risk. In other words, most insurance companies such as State Farm, Farmers, Allstate, Travelers, Hartford, and Chubb will not insure buildings with cannabis tenants.

Professional Tip: Knowing you are insured by an approved cannabis insurance company reduces your risk and provides peace of mind

What You Need to Know about Cannabis Building Insurance

What are important coverage considerations for my building?

- Be certain the building is insured to replacement cost. A third party estimate from the insurance broker can help determine the right limit. If the building is underinsured, this can result in additional funds being paid out of pocket along with a coinsurance penalty.

- Loss of income/rents is important coverage limit to recognize providing valuable income after a loss.

- There are significant risk differences when leasing to a dispensary, cultivation, or manufacturer. Knowing these differences will help procure the right type of coverage. For example, a dispensary or store is likely to experience claims caused by theft as opposed to a grow facility who could experience a fire or moisture damage.

Professional Tips:

- Obtain a third party building replacement estimate.

- Understand there are different risk for different operations.

- Carefully consider your lease requirements

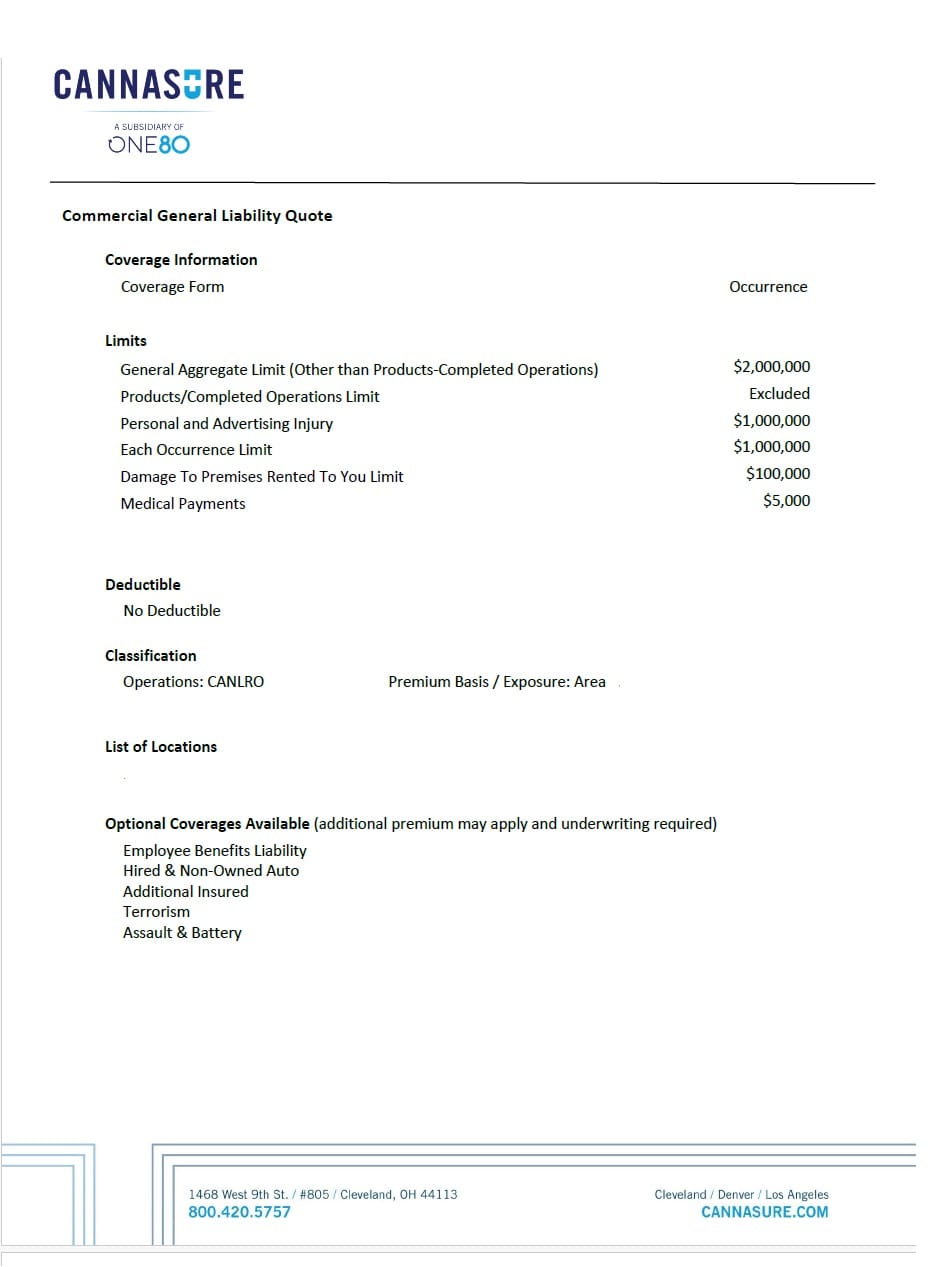

Sample Quote: Understanding Liability Coverages

- Liaiblity insurance is designed to protect the building owner from third party claims. A simple example might be a person visiting who slips in the parking lot.

- The limits are broken down by the coverage type. A $2,000,000 aggregate is the maximum limit on the policy for multiple claims. A $1,000,000 occurrence limit indicates the maximum amount of coverage for one claim. Higher or Excess Limits are available for landlords who seek additional peace of mind.

- Medical payments of $5,000 helps to pay for smaller claims in order to help make things right.

What is Products/Completed Operations? Why is it “Excluded?”

Cannabis insurance companies have been removing or excluding this coverage for numerous years. The reason is likely due to the potential risk from a product liability claim. This is the “products” portion of the coverage. Example, your tenant is a manufacturer of gummies. A lawsuit is filed by a third party who became ill because of the gummies.

As a landlord, what happens I were to sued because of a product liability claim because of my tenant’s business?

The insurance carrier is likely to deny the claim because the coverage was excluded or removed.

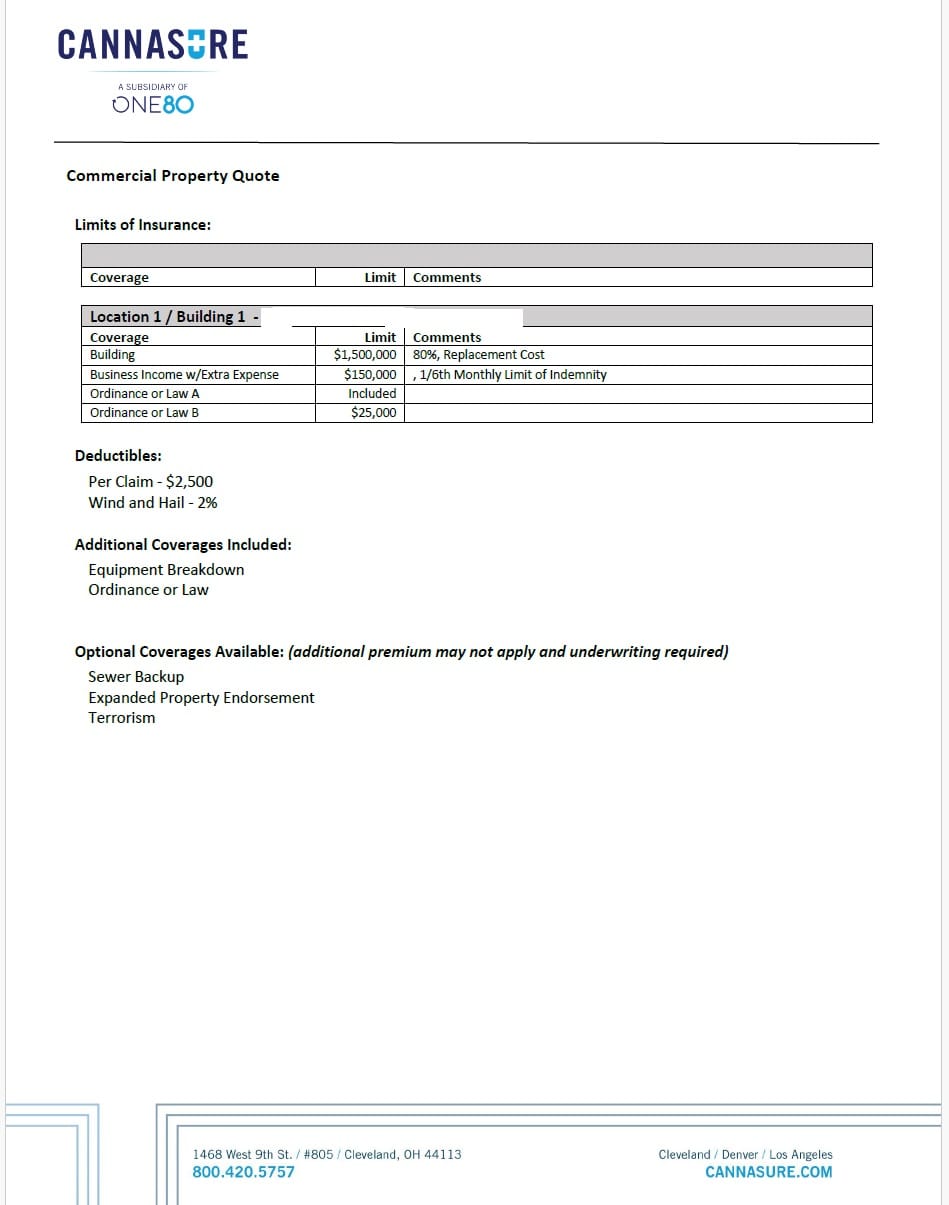

Sample Quote: Understanding the Building and Property Limits

- The sample quote to the right indicates $1,500,000 of building coverage. This is the amount insuring the physical structure. To the right of this limit is 80% coinsurance and replacement cost. Coinsurance is a penalty IF the building is underinsured. Replacement cost avoids depreciation being applied to a claim.

- Business income and extra expense represents loss of income due to a property loss. The 1/6th monthly limit indemnity means the limit is divided by 6 months. Based on the sample quote, the $150,000 divided by 6 would equal $25,000 per month.

- Ordinance or Law coverage provides coverage, if a local ordinance requires the building structure to adhere to a specific requirement. Example, the building is partially damaged by a fire. The local ordinance requires the remaining structure to be demolished. Without this coverage, the carrier is likely to enforce a existing ordinance or law exclusions.

- Depending on where you’re located, you might have a separate deductible for wind/hail. The sample quote indicates a 2% deductible. Learn more about the cost difference with a separate wind/hail deductible.

Insurance for Greenhouses

General Liability, Building, and Property Insurance Coverage Options for Cannabis Greenhouses

- General Liability covering the greenhouse premise protection. This coverage is important because it provides coverage from third parties who have suffered damage including legal defense.

- The cost to rebuild a greenhouse can be significant. We have acces to high limits available for Greenhouse building structure to meet those needs.

- Wind/Hail coverage available through select insurance companies. Knowing your greenhouse is covered for wind/hail is perhaps one of the more important coverage to choose. In our experience, we have clients who have experienced significant damage from wind.

- Loss of income/rents to allow income continuation. This coverage is important after a property loss, the income generated by the tenant is in jeopardy. Debt and other expenses will continue, while income is no longer available.